Legal and tax advice

We answer your questions in French and Andorran, whether you are an individual or a business owner.

OUR EXPERTISE

Corporate taxation

The firm assists companies of all sizes — from very small businesses to international groups — in managing and optimizing their taxation, whether it concerns their current business or exceptional operations.

We deal with all taxes and duties (income tax, corporate tax, VAT, local taxes, transfer pricing) while ensuring that each step is secure.

Our expertise covers both day-to-day taxation and strategic operations:

Advice

Development and growth:

Tax structuring of acquisitions, audits and due diligence, mergers and acquisitions.

Reorganization:

Mergers, spin-offs, partial asset transfers.

International taxation:

Intragroup flow management, permanent establishment risk analysis, transfer pricing policy, processing of withholding taxes and cross-border VAT.

With our presence in Andorra and strong partnerships in France and internationally, Sol Fiscal has particular expertise in supporting industrial, innovative companies with high development potential.

OUR EXPERTISE

Personal taxation

The firm assists individuals in all their tax procedures, whether related to the day-to-day management of their assets or to more ambitious reorganization projects.

We handle all tax-related matters, in France, Andorra and internationally:

Advice

Inheritance transfer:

Donations, inheritances, division of ownership, transfers…

Investment structuring:

Real estate, whether purchased directly or through a company, unfurnished or furnished rentals, income tax or corporate tax.

International mobility:

Expatriation, change of tax residence, tax regime optimization, exit tax.

Tax returns:

Income, IFI, assets located in France and/or abroad.

Regularization:

Bringing assets held abroad into compliance.

Thanks to our presence in Andorra and a strong network of partners in France and internationally, we provide you with tailor-made solutions, in a secure and legally compliant framework, to protect your interests and optimize your projects.

A team ready to listen to you

The firm’s skills

Legal and tax advice

Matthieu Bech – Managing Partner – Tax Law

Skills and Expertise

Cross-border restructuring schemes (Holdings – LBOs)

Transfer (Disaggregation – Dutreil Pact…)

Expatriation advice and tax residency transfer – Exit tax

Management of international projects, particularly Franco-Andorran projects, and tax-related consulting for these operations.

Academic curriculum

Targeted experience in the tax field

“After a career in investment banking and as an independent consultant for SMEs/mid-sized companies and occasionally listed groups, I settled in the Principality of Andorra to secure my clients’ practices, their expatriation projects, or their tax structuring.”

Degrees and Training

Graduated from the University of Warwick with merit (2018) – Major in International Law, Economics and Finance – MSc in Management

Graduate of the European University of Viadrina – BSc International Business Administration

Graduate of Toulouse Business School and Arizona State University.

Administrative management

Léa Lopez

Partner – Project Management

Sergi Brillas

Associate – Institutional Relations

Carlos Sasplugas

Customer relations – Installation

Cédric Pierrot

Gestion de projets

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

Find us:

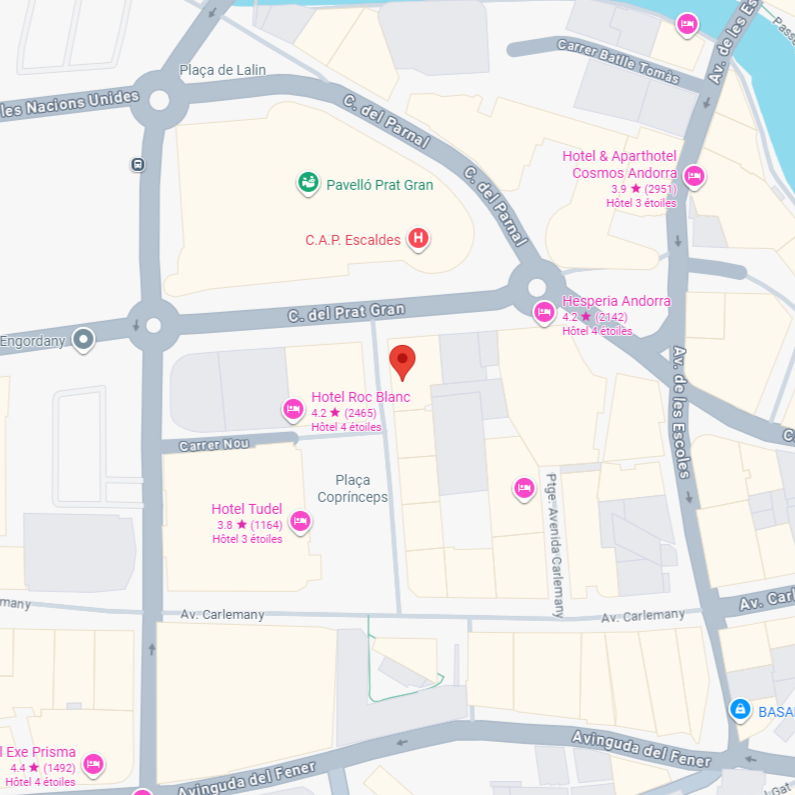

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)