France/Andorra Convention

Better understanding how double taxation avoidance agreements work

Double expertise

Our areas of action

At Sol Fiscal, we support entrepreneurs, investors and individuals (active or retired) in structuring and optimizing their projects in Andorra.

With expertise covering both sides of the border, our team is ready to support you from day one of your project and throughout its development.

We work closely with a network of French and Andorran practitioners to offer you a complete and integrated service, ensuring that your ambitions are realized within a safe and favorable legal framework.

Franco-Andorran tax expertise

Establishment of residence, not only with regard to Andorran criteria but also to article 4.B of the CGI and the bilateral convention.

Structuring of cross-border activities, permanent establishments.

Tax regimes for dividend payments, cross-border restructurings and Andorran activities.

We will assist you in informing you about the processing of the operations you are planning.

French section

Exit tax and transfer of tax residence:

Any taxpayer leaving France must check whether they are required to complete the exit tax formality.

We will inform you of your obligations where applicable and plan the formalities with you.

Contribution of securities and holding companies:

Applicable regime, reporting formalities, presentation of all necessary contacts or collaboration with your usual advisors.

Sales, LBOs, OBOs and other capital transactions.

Transfer pricing, presidential compensation, management fees.

Transfer (gift/inheritance), division of ownership rights, Dutreil agreement…

Intra-group cash pooling agreements.

Transfer pricing, intellectual property, permanent establishments and tax representation (including VAT-related matters).

Andorran section

Obtaining residency in Andorra and related formalities.

Company formation: choosing its form, drafting the articles of association, the corporate purpose and subsequent amendments.

Opening bank accounts and introducing you to various contacts in the areas of financing, investment, etc.

Capital increases through contributions of securities or in kind.

Business development (Trade Register).

Support regarding the real estate aspect:

Primary or secondary residence.

Rental investment.

Promotion or merchant operations.

Achat de terrain et construction avec notre réseau de partenaires (architectes, constructeurs…).

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

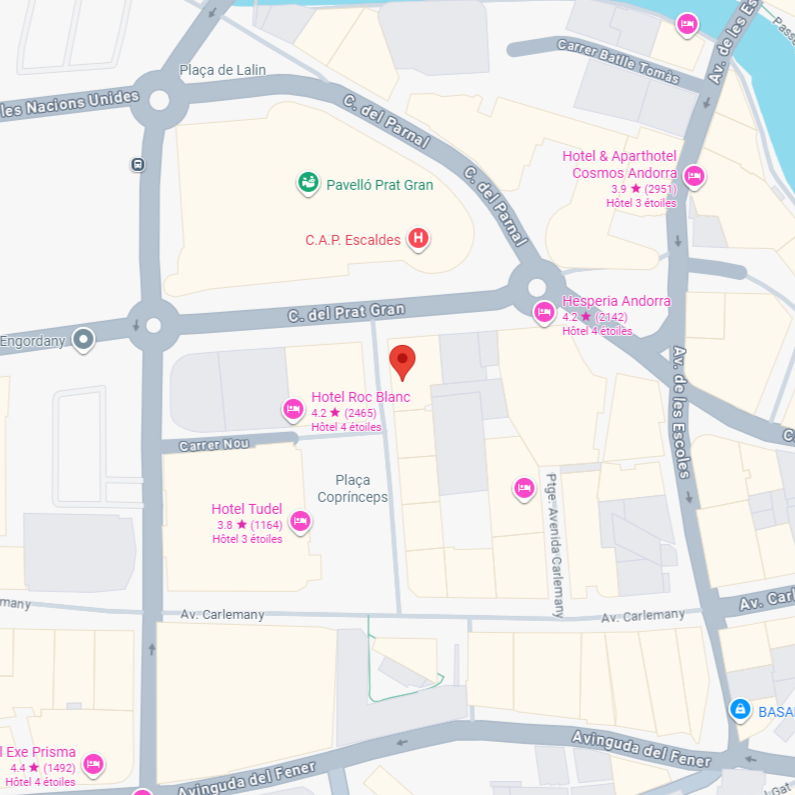

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)