Pass on your heritage

Finding the best strategies to secure and optimize the transfer of your family’s wealth.

Andorra side

The Andorran tax framework for the transfer of assets

No inheritance tax

- Depuis la loi de 2016, aucun impôt n’est prélevé sur les successions ou donations entre résidents andorrans.

- This concerns transfers between parents, children, spouses, but also between third parties if residence is proven.

Donations entre vifs

- Donations can be made freely, without taxation.

- It is recommended to use an Andorran notary to register the deed and guarantee its validity (land register, cadastre, etc.).

Transfer via a holding company

- Creation of an Andorran asset management company to hold assets (real estate, portfolio, shares).

- Benefits :

- Transfer facilitated by the sale of shares.

- Legal and tax protection.

- Optimizing capital gains and rental income.

Transmission and donation

Schemes compatible with Andorra

Direct donation

- Notarized deed between family members.

- No tax, but registration is advised for real estate.

Heritage company

- Legal form: SL or SA.

- Asset ownership (real estate, securities, crypto).

- Transmission by transfer of shares or donation of shares.

Family holding

- For families with multiple assets or companies.

- Allows for structured governance and gradual transfer.

Testament andorran

- Drawn up by a notary, in accordance with local law.

- May include specific clauses (usufruct, distribution, etc.).

a much lighter tax

Comparison France vs Andorra

Andorra vs France: Inheritance Comparison

| Criteria | Andorra | France |

|---|---|---|

| Existence of an inheritance tax | No, there are no inheritance or gift taxes. | Yes, inheritance tax is calculated on the net share of each heir. |

| Tax scale | 10% maximum | Progressive according to the degree of kinship: |

| Allowances | No reduction is necessary because there is no taxation. | - €100,000 per child. |

| Transfer between spouses/civil partners | Transfer completely exempt from tax (no taxation) | Full exemption for the surviving spouse or civil partner |

| Formalités | Formalization by a notary is recommended for registration in the land registry/cadastre. | Mandatory declaration to the tax authorities; notary services recommended. |

| Tax objective | Promoting economic attractiveness and family succession without tax burdens | Generating tax revenue and regulating the transfer of assets |

Some details

Practical advice and points to be aware of

Tax residence

- To benefit from the exemptions, you must be an Andorran tax resident.

- This implies compliance with the residency criteria of Andorra and your country of origin.

- With regard to real estate, additional taxation may be due in the country where the property is located.

Securing the transactions

- Always use an Andorran notary for donations, inheritances, wills for properties located in Andorra.

- Register the deeds in the land or commercial register if necessary.

Anticipating the succession

- Prepare a will in accordance with Andorran law and the laws of the countries in which the assets are located.

- Structuring assets through a company to facilitate transfer and optimize inheritance rights.

Beware of properties located in France

- Real estate or bank accounts in France remain subject to French taxation.

- It is possible to optimize through cross-border agreements or arrangements.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

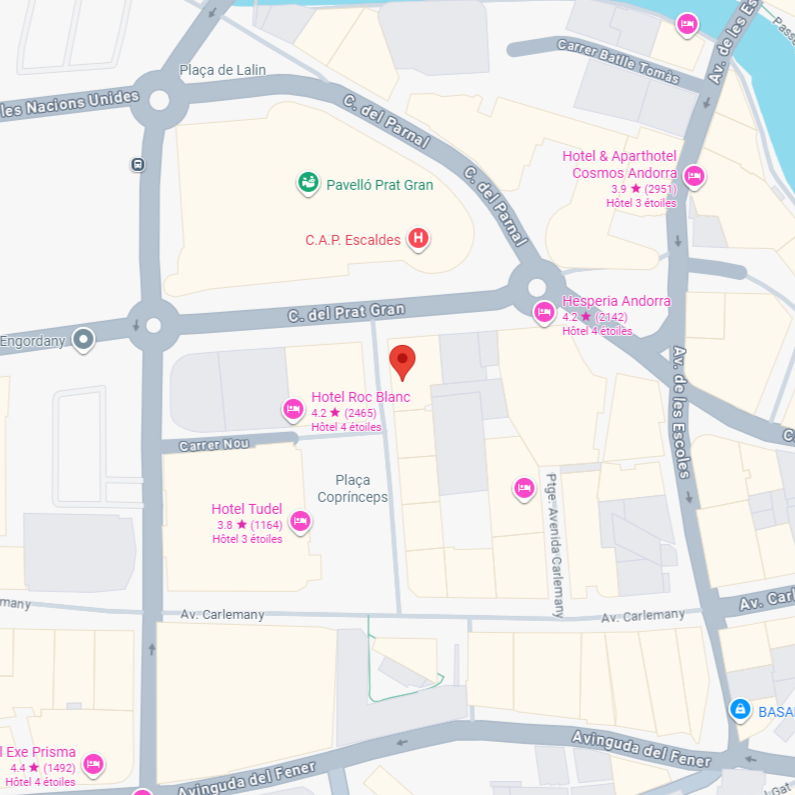

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)