Emigrated outside of France

Moving abroad is a decision that goes far beyond simply changing countries. It requires meticulous preparation,

both in terms of taxes and legal matters, as well as personal relocation.

Anticipating each step is essential to transforming this project into a genuine opportunity.

Thorough preparation is key to a successful transition.

The importance of planning ahead for expatriation

Before taking the plunge, it’s essential to assess the impacts of expatriation: taxation, social security coverage, inheritance rights,

but also practical aspects such as housing and children’s schooling. Structured planning helps avoid unpleasant surprises and secures your long-term project.

Tax and wealth analysis

Understanding the impact of local taxation and anticipating asset management.

Administrative and social organization

Health insurance, retirement, bilateral agreements, social rights.

Personal and family preparation

Housing, schooling, cultural and linguistic adaptation.

A harmonized framework but national specificities

Expatriation within the European Union

Moving to a European Union member state offers a certain degree of flexibility: freedom of movement, recognition of qualifications, and easier access to healthcare and employment systems. However, each country retains its own tax and wealth laws.

A comparative analysis therefore remains essential to optimize your installation.

Freedom of movement and work

Simplified mobility, recognition of diplomas and qualifications.

Taxation and wealth

Differences exist between member states despite a common European basis.

Access to public services

Health, education and social protection with continuity of rights.

Expanded opportunities, reinforced constraints

Expatriation outside the European Union

Outside the EU, expatriation opens the door to sometimes more attractive tax environments and diversified wealth-building opportunities.

On the other hand, administrative procedures are more complex: visas, residence permits, bilateral tax treaties,

and sometimes restrictions on real estate investment. Solid legal and wealth-planning preparation is therefore essential.

Legal and administrative framework

Visas, residence permits, specific authorizations.

International taxation

Bilateral agreements, double taxation, tax opportunities.

Investments and assets

Potential restrictions on real estate, financial transfers, and asset management

Taxation of different destinations

Tax-attractive countries

Europe

Bulgarie

Flat tax of 10% on income and corporations.

Portugal

NHR (non-habitual resident) scheme with exemptions for 10 years.

Estonie

Corporate tax only upon distribution of profits (20%).

Irlande

Corporate tax at 12.5%, known to attract multinationals.

Suisse

Competitive cantonal rate (12–14%), stability and bilateral agreements.

Asie

Singapour

Corporate tax at 17%, numerous tax breaks, progressive but moderate personal taxation.

Hong Kong

Corporate tax at 16.5%, tax territoriality (foreign income not taxed).

Géorgie

Simplified flat tax, a system favorable to entrepreneurs and investors.

Émirats Arabes Unis

No income tax, corporation tax recently introduced at 9%.

Amérique

Canada (certains provinces)

Competitive taxation for innovative companies, R&D tax credits.

Chili

Stable taxation, bilateral agreements, attractive for foreign investment.

Uruguay

Territorial regime, untaxed foreign income, transparent legal framework.

Océanie

Australie

Competitive taxation for businesses, a clear and stable system.

Nouvelle‑Zélande

Corporate tax at 28%, but a transparent and attractive tax environment for foreign investors.

L’andorre hors Europe

Et l’Andorre en comparaison de ces pays

Tax benefits

- Competitive tax rates: income tax capped at 10%, corporation tax at 10%, with no wealth or inheritance tax.

- Stability and transparency: unlike some more “aggressive” regimes (Hong Kong, Emirates), Andorra is recognised by the EU and the OECD as a cooperative jurisdiction.

- Attractive property taxation: no annual property tax, moderate transfer taxes, competitive rental yields.

Geographical location and living environment

- Proximity to France and Spain: direct access to European markets, while remaining outside the EU.

- Quality of life: preserved natural environment, high safety standards, lower cost of living than Switzerland or Ireland.

International community - growing: expatriate entrepreneurs, investors and families attracted by the tax framework and stability.

Administrative and heritage framework

- Residence accessible via investment: relatively low investment threshold compared to Switzerland or the Emirates.

- Solid banking system: confidentiality respected but compliant with international standards.

- Protected assets: no wealth tax and easier inheritance

In summary

Every expatriation project is unique. Being supported by experts allows you to secure your choices and transform your departure into a genuine lever for personal and financial growth.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

Find us:

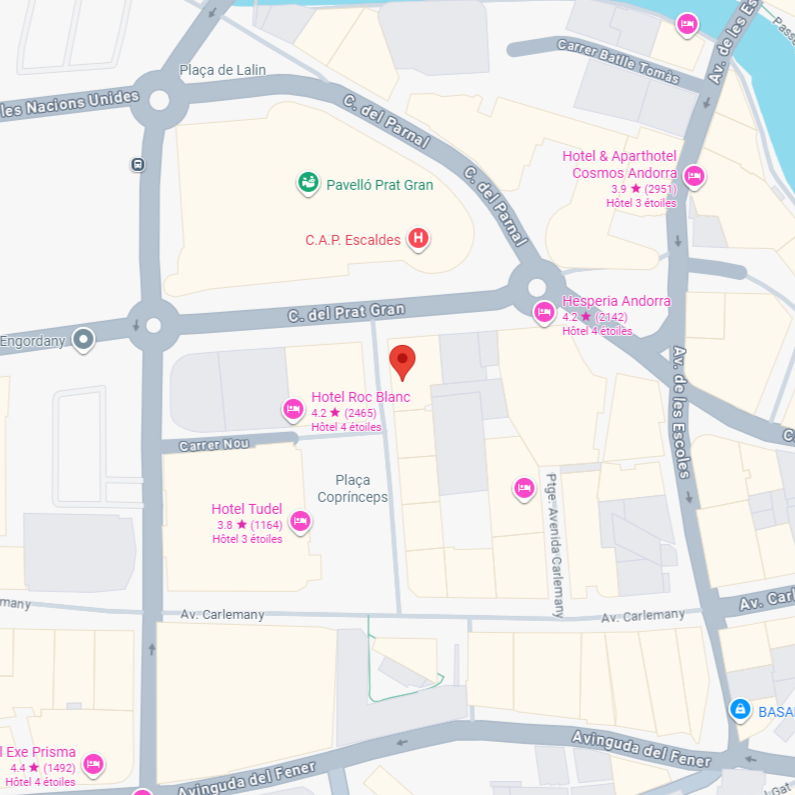

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)