Investing abroad with peace of mind

Diversify your investments into new destinations to enhance security and achieve better returns.

SOL Fiscal is a Franco-Andorran consulting firm and Family Office that supports its clients in all their tax and wealth management challenges, offering tailor-made, sustainable solutions that comply with French and Andorran regulations.

ANY QUESTIONS?

Expatriate Investor

Secure and optimize your portfolio

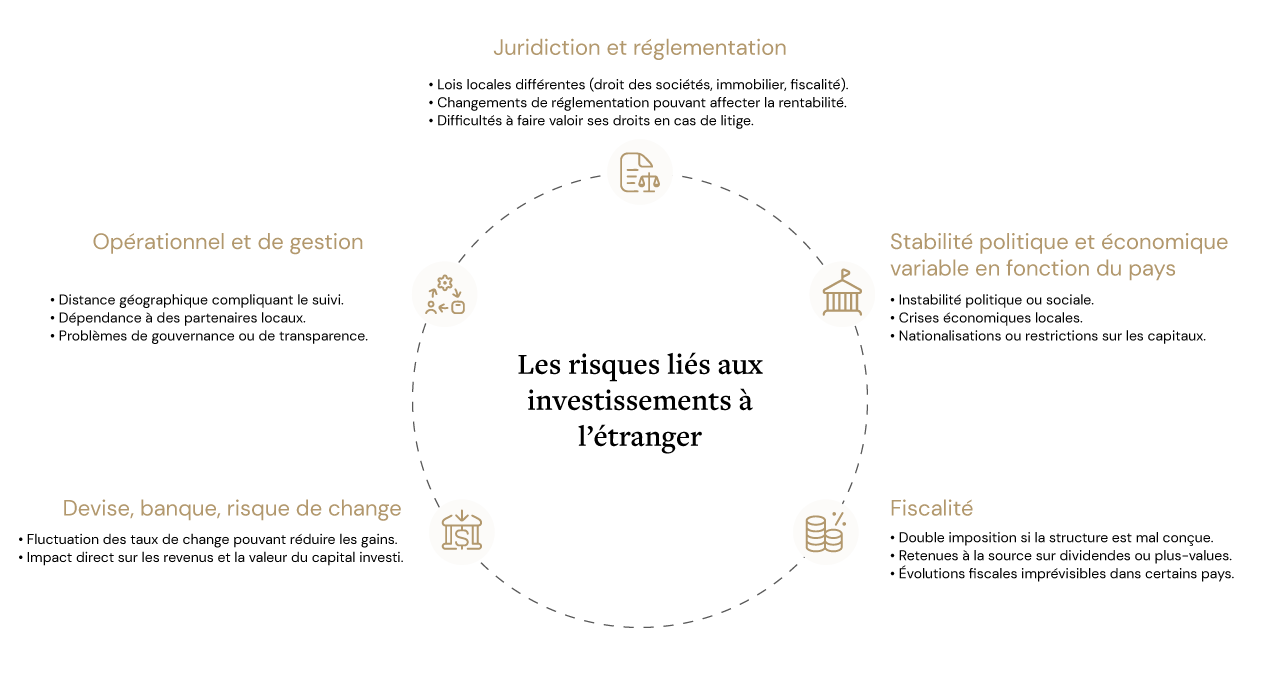

As an expatriate investor, your opportunities are vast, but your pitfalls are often invisible. This guide identifies the specific risks associated with cross-border flows and provides you with priority actions to secure and optimize your portfolio.

Profitability

Security/trust

Diversification

Ways to protect yourself against:

Our recommendations: Choose experienced individuals with a good understanding of the local market and current regulations, capable of offering solutions tailored to your objectives without taking undue risks. (brief conclusion below the diagram)

Expatriate Investor

Other important topics need to be addressed.

the risks when you want to move abroad and you already own assets (changes in taxation, inheritance, etc.)

We help you with your projects

Types of projects accessible in Andorra

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)