Managing and diversifying your assets

as an expatriate

Make your mobility a lever for performance.

SOL Fiscal is a Franco-Andorran consulting firm and Family Office that supports its clients in all their tax and wealth management challenges, offering tailor-made, sustainable solutions that comply with French and Andorran regulations.

ANY QUESTIONS?

Optimize your international taxation

Analyze your tax situation before and after expatriation to benefit from the most favorable regimes and avoid double taxation.

Secure your resident status

Anticipate the administrative, tax and banking aspects related to your change of residence and ensure your compliance with the French and Andorran authorities.

Préparer la transmission et la succession

Structure your assets to anticipate the transfer of your wealth within a secure international framework.

NOS OBJECTIFS

What are the risks of an uncontrolled expatriation to Andorra?

A poorly planned expatriation can lead to major tax, legal and asset-related risks:

In Andorra, it is possible to manage one’s assets independently, but without in-depth knowledge of the specificities of Franco-Andorran law, the risks of non-compliance remain high.

Rigorous planning and specialized support are essential to transforming these challenges into opportunities for optimization and sustainable security.

Our philosophy

To offer sustainable solutions that fully protect your interests

Expertise and confidentiality

Sol Fiscal combines local and international expertise to offer you personalized support in tax optimization, investments and inheritance.

We bring together the essential skills for the success of your projects in Andorra, in compliance with legal and ethical obligations.

Transparency and independence

Transparency guides each of our decisions, for objective, methodical support that is always aligned with your real interests, without bias or external influence.

Our advice is based on your situation and your objectives. We move forward alongside you with complete confidence and transparency.

Attentive and close to you

Aware that every family has its own history, values and priorities, we attach particular importance to understanding your situation and expectations.

In order to choose suitable solutions, in perfect harmony with your family objectives and with the protection and transmission of your assets.

Tailor-made support

To allow you to:

Implementing a succession strategy that complies with French and Andorran law

Adapt your investments and wealth structures to your new tax residence to maximize your net return and legal security.

Optimize the management of your income and investments

Adapt your investments and wealth structures to your new tax residence to maximize your net return and legal security.

Investing in Andorra in real estate or financial assets

Take advantage of Andorra’s attractive tax environment and economic stability to diversify your investments and sustainably grow your wealth.

Enjoy a healthy and safe living environment

Enjoy a preserved natural environment, an exceptional level of security and a recognized quality of life, ideal for reconciling personal balance and professional success.

And without forgetting…

Unique opportunities for expatriates

Find your happiness in your preferred fields and sectors.

Expanding its operations

into a new market

Real estate purchase for residential or rental purposes

Private equity and

acquisition of stakes

Diverse and attractive banking services

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

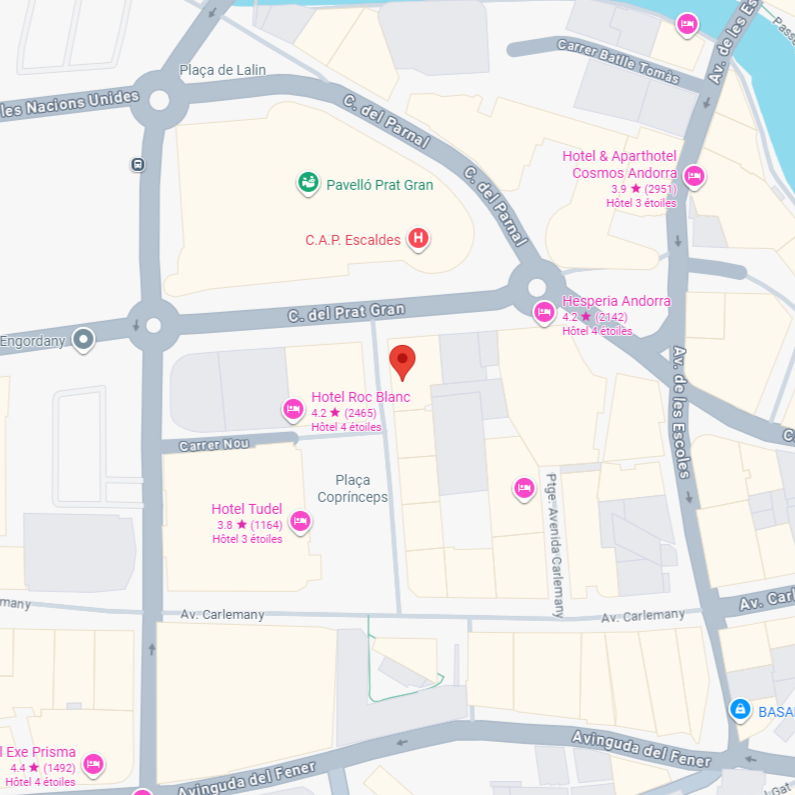

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)