Optimizing and securing your assets

as an individual

Opting for international diversification.

SOL Fiscal is a Franco-Andorran consulting firm and Family Office that supports its clients in all their tax and wealth management challenges, offering tailor-made, sustainable solutions that comply with French and Andorran regulations.

ANY QUESTIONS?

Reduce your taxes

Have your situation analyzed to identify the most advantageous tax regimes and schemes according to your profile, income and structures.

Diversify and secure your assets

Establish a comprehensive view of your assets in order to diversify your investments — real estate, companies, cash, financial products — while preserving your legal and tax security.

Improve the profitability of your investments

Select the most relevant investment solutions according to your return profile and investment horizon from the solutions presented.

Preparing for your expatriation

Anticipate the tax and asset consequences of your relocation: benefit from personalized support on all aspects of your move.

Ensuring your compliance and administrative peace of mind

Centralize your tax and reporting obligations to avoid errors or inconsistencies between France and Andorra.

Prepare for the transfer of your assets

Anticipate the civil and tax aspects of family inheritance to protect your loved ones and control the overall cost of the estate.

Investing in real estate in Andorra

Take advantage of a dynamic and fiscally attractive real estate market to diversify your assets.

Managing your real estate wealth tax (IFI)

Reduce your exposure to the IFI through appropriate structuring, accurate valuation of your assets and effective coordination with your Andorran strategy.

Diversifying your portfolio of international financial investments

Access a diversified management offer through Andorran banking institutions, renowned for their stability and international expertise.

Increase your income while reducing your taxes

Benefit from reduced taxation through better organization of your professional and asset income to maximize net return.

LIVING ONE’S RETIREMENT IN ANDORRA

Benefit from a tax-advantaged retirement

Receive your French pension in Andorra without CSG/CRDS

No wealth tax (IS)

No wealth tax on real estate (IFI)

OUR EXPERTISE

Solid experience at the service of your assets

Families supported.

People to support you at every stage of your project.

From local experience.

ECONOMIC SITUATION & OPPORTUNITIES

Key figures Andorra

378.5 million euros

Foreign investment in Andorra by 2024.

14.4%

Growth in capital gains

on real estate over the past year.

+ 47,2 %

Regarding real estate over this 5-year period.

+ 8,69 %

Increase in the Andorran population

between January 2023 and October 2025.

+ 7084

New residents between January 2023 and October 2025

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

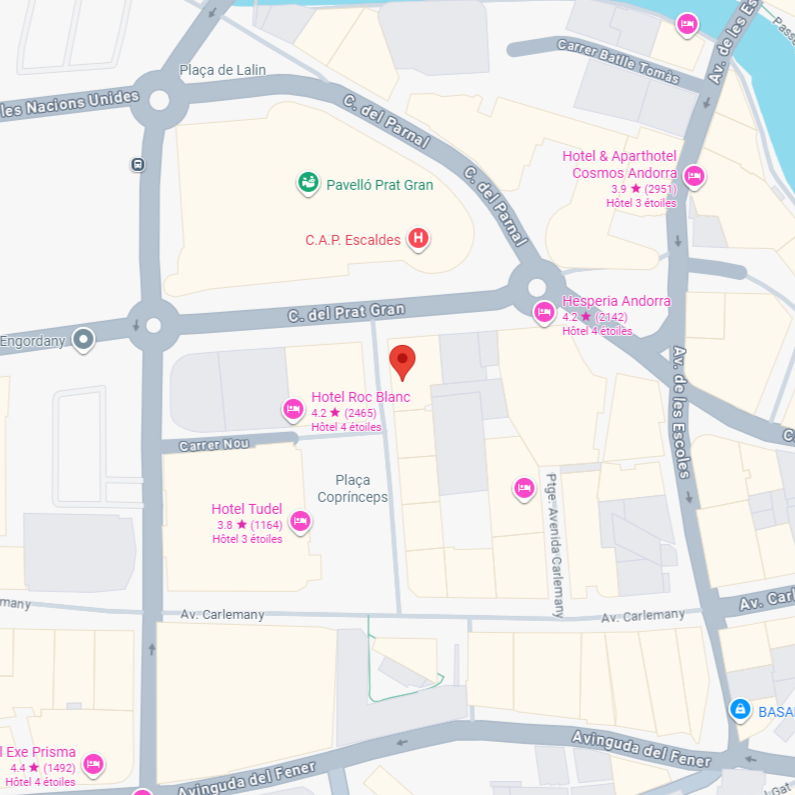

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)