Why Andorra is a strategic tax destination

Discover the data relating to Andorran taxation.

OUR EXPERTISE

An ultra-competitive tax framework

The Sol Fiscal firm supports you in all your legal and tax procedures between France and Andorra, whether it concerns relations between companies established on both sides of the 2 territories (parent-subsidiary regimes, tax integration, cross-border distributions), the applicable rules regarding VAT or situations of dual tax residence.

Our expertise is based on a thorough understanding of Franco-Andorran tax treaties, covering income, capital gains, and wealth transfer. We secure your transactions within a compliant, optimized, and sustainable framework.

Personal income tax (IRPF):

Progressive rate from 0% to 10%. Exemption up to €24,000, then 5% up to €40,000, and 10% above that.

Corporate income tax (CIT):

Fixed rate of 10%, with possible discounts for innovative or international activities.

Local VAT (IGI):

Only 4.5%, one of the lowest in Europe.

No wealth tax

nor on inheritances or donations.

Taxation in Andorra

How to benefit from Andorran taxation

For the development of a commercial or asset management activity

Legal status :

SL (Sociedad Limitada), equivalent to SARL.

Capital minimum :

3 000 €.

Registered address:

Office or physical location required.

Economic substance:

Business activity, website, billing and local presence.

Active residence:

It is possible to apply for a residence permit as a company director, subject to compliance with the applicable legal criteria and the availability of annual quotas, the granting of this type of residence being conditional on the existence of authorizations still available for own account activities (capped at 200 authorizations per year).

For people who choose to live abroad without engaging in commercial activity

Conditions :

Security deposit to the AFA (variable depending on the year of application), private health insurance, accommodation in Andorra, minimum presence of 90 days/year.

Benefits :

No obligation to have a company or an employment contract, ultra-light taxation on capital income.

Ideal for:

Retirees, rentiers, investors.

To centralize its assets and develop its activities in the principality

Objective :

Holding stakes in foreign companies.

Taxation:

Dividends and capital gains are taxed little or not at all (see tax treaties).

Attention :

Legal study is needed to ensure the choice and viability of the scheme.

Taxation in Andorra

Comparison France vs Andorra

Andorra vs France: Tax Comparison

Visualize the potential savings with Andorran taxation.

| Taxation | Andorre | France | Economy |

|---|---|---|---|

| Income tax | 10% maximum | Up to 45% | Up to 78% |

| Corporate tax | 10% maximum | 15% or 25% | 60% |

| VAT | 4,5% | 20% | 77% |

| Real Estate Wealth Tax (IFI) | 0% | Up to 1.50% | 100% |

| Inheritance taxes | 0% | Up to 45% | 100% |

| Social charges | 22% | Up to 45% | Up to 51% |

* Savings percentages calculated based on maximum rates

Our advice

Points to be aware of and practical advice

Set up a company abroad only if you wish to:

to develop activities, whether commercial or related to heritage, in the country in question

Investing in foreign assets

Moving abroad under good conditions

Develop international activities (to be studied depending on the project)

France-Andorra tax treaty applicable since 2015

It helps avoid double taxation

It establishes a clear framework to secure your operations

Some income (real estate, French salaries, inheritance tax, etc.) may remain taxable in France (request a study of my situation).

Preparing for your expatriation

Change of tax residence with the tax authorities

Termination of French contracts (health insurance, EDF, etc.)

Proof of residence, activity, insurance

Surround yourself with professionals

Andorran stories:

For local procedures.

Tax lawyers:

To secure the assemblies.

Chartered accountants:

For accounting and tax returns.

SOL Fiscal brings together all these skills in-house, ensuring its clients comprehensive, coherent and secure support, with a single point of contact for all their procedures in Andorra.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

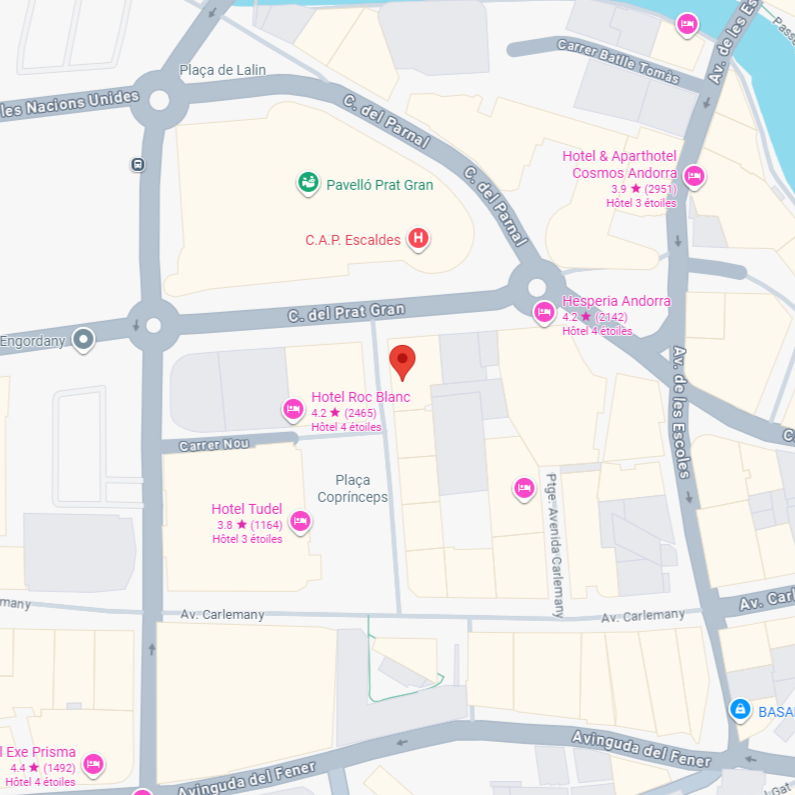

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)