Our approach

A comprehensive and structured approach to secure your decisions France ↔ Andorra

Analyze your situation and objectives on both sides of the border

1. Analyze

As a law firm and family office, we begin each engagement with a comprehensive analysis of your personal and financial situation, both in France and Andorra. This cross-assessment of your objectives, assets, and tax position allows us to design solutions best suited to your needs and long-term strategy.

Personal situation

Personal structure, family structure, family ties, matrimonial property regime, wealth management objectives, inheritance.

International taxation

Income tax (IR), wealth tax (ISF), inheritance tax, corporation tax (IS).

Heritage

Asset and corporate structure, real estate, transfer, inheritance, placements and investments.

Projection

Feasibility of your projects, impact on your taxation and that of your family, reverse planning and diagramming.

Structuring your assets and cash flows within a harmonized tax framework between France and Andorra

2. Structure

We define the most relevant schemes to organize your companies, your revenues and your investments, while ensuring their compliance and cross-border efficiency.

Tax strategy

We identify the tax schemes best suited to your situation and your projects, within the Franco-Andorran framework.

Wealth management strategy

Together we define a comprehensive wealth management strategy that balances performance, security and consistency.

Investment strategy

We find and present investment opportunities to you and coordinate the key players involved in their realization.

Life project

When there is a desire to move abroad, we are committed to ensuring its success within a clear, compliant and sustainable framework.

Oversee the implementation of the chosen solutions, with rigor and in compliance with France-Andorra regulations.

3. Implementation

We coordinate the implementation of your legal, tax and administrative solutions between France and Andorra and support you in the search for investments in the Principality and, if necessary, assistance with your relocation to Andorra.

Group structuring

Handling of formalities directly or through our associates: Dutreil Pact, LBO, transfers, donations, contributions of securities…

Asset diversification

Presentation of products matching your risk profile and in line with your objectives, connecting you with the right contacts for purchase and management.

Business creation

Formalities for setting up your company in Andorra, project management and French procedures for your expatriation and coordination of key players in bringing the project to fruition.

Résidence en Andorre

Formalities for obtaining active or passive residence and administrative procedures related to your move, exit tax, real estate, banking.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

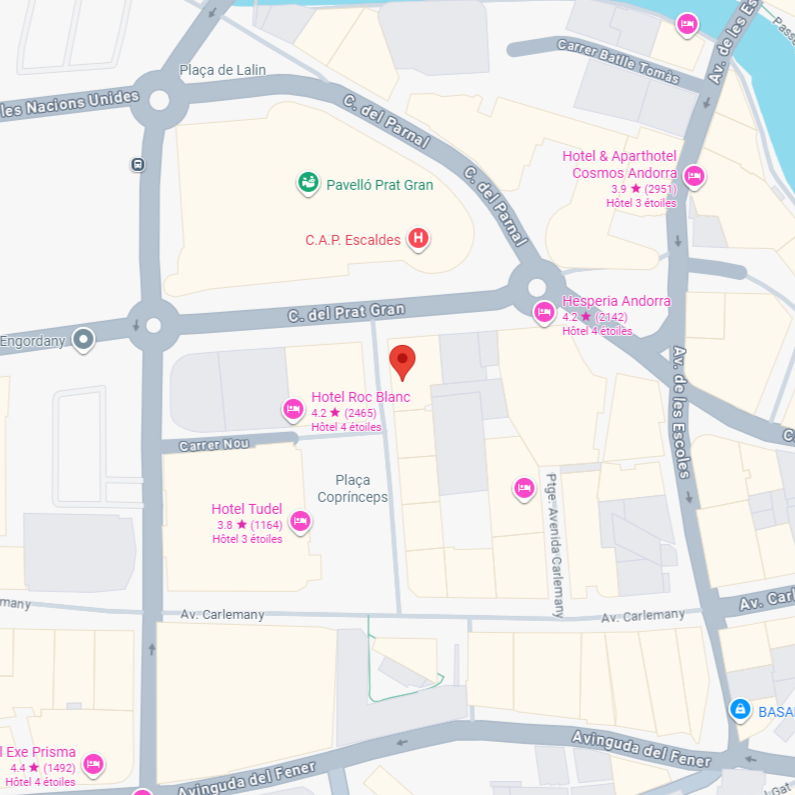

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)