The projects managed by the firm

Build, structure and grow your projects in Andorra with cross-border expertise

combining taxation, wealth management and investment strategy.

Structuring, supporting, and growing your ambitions

Business creation and group structuring

Definition of the plan to be implemented

Choice of legal form

Completion of formalities

Presentation to the necessary stakeholders

Administrative management and monitoring

Facilitating, securing, and ensuring the success of your expatriation

Obtaining residency in Andorra

Do you wish to move abroad and obtain Andorran residency?

We guide you through every step, from analyzing your profile to the official issuance of your residence permit.

Depending on your investment goals, professional activity or retirement, we will define the most suitable residency status:

Active Residence

For business leaders or self-employed individuals operating in Andorra.

Passive residence

For people wishing to settle in Andorra without carrying out any professional activity there.

International Screening

For people wishing to reside in Andorra while carrying out the majority of their work outside of Andorra.

We provide comprehensive support:

File preparation, relations with administrations, account opening, obtaining the NIA, health insurance, housing, taxation and residency obligations.

The objective:

Make your installation simple, compliant and sustainable, while optimizing your tax and asset status.

ANY QUESTIONS?

Analyze, optimize, and enhance the value of your investments

Investment projects

We help you choose the right setup and can handle everything for you. But beyond that, we’ll be your partner in developing your projects in the Principality of Andorra and the surrounding areas.

Here are some examples of projects that interest our clients:

Miscellaneous investments:

Financial products:

Shares of Andorran and international companies

Andorran investment products (ICO, SICAV, ETF, etc.)

Benefit from the same products you already know with a more favorable tax regime: between 0 and 10% tax.

Real estate development project:

Real estate is a booming market, which creates numerous investment opportunities.

Every project requires funding. More and more project developers are looking for serious investors for their projects (fundraising for new developments).

We are regularly in contact with project developers to find highly profitable programs for our clients.

One of the most recent examples is the construction of more than 100 houses in one of the most sought-after parishes in Andorra.

Real Estate Investment

Property trading operation:

In new construction: An investor acquires an apartment off-plan in a high-end residential development for an average price of €5,500/m². After delivery, resale can generate an average margin of 15%.

In the old market: Purchase prices for old or renovated properties are roughly the same.

Rental purchase:

An apartment worth €400,000 can be rented for around €2,000/month or more depending on the size of the location, representing a net return of 5 to 6%, higher than the French average.

Since there is no property tax in Andorra, the net profitability of projects is significantly improved.

Advising, guiding, and realizing your life projects

We support you

Sol Fiscal assists you in obtaining your tax residency in Andorra.

Our team assists you at every stage of your relocation, facilitating your administrative and logistical procedures: finding accommodation in conjunction with local agencies, identifying suitable schools, and even finding and registering a vehicle.

We also offer you access to our network of qualified professionals in taxation, business law and legal matters.

Our commitment: to provide you with personalized advice, in compliance with current regulations.

Real estate research, installation

Find your new primary or secondary residence

In Andorra:

Whether you are looking for a primary or secondary residence, Andorra has exceptional properties, combining traditional quality architecture and materials with the comfort, design and practicality of modern finishes.

It is possible to find your happiness in the heart of the capital to be at the center of the activity of the principality, or in parishes like La Massana or Ordino, offering you magnificent views and small towns with all the necessary amenities.

around:

Andorra being particularly well positioned, close to the French and Spanish Mediterranean coasts and Portugal, it frequently happens that French expatriates also wish to have a foothold in these privileged destinations.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

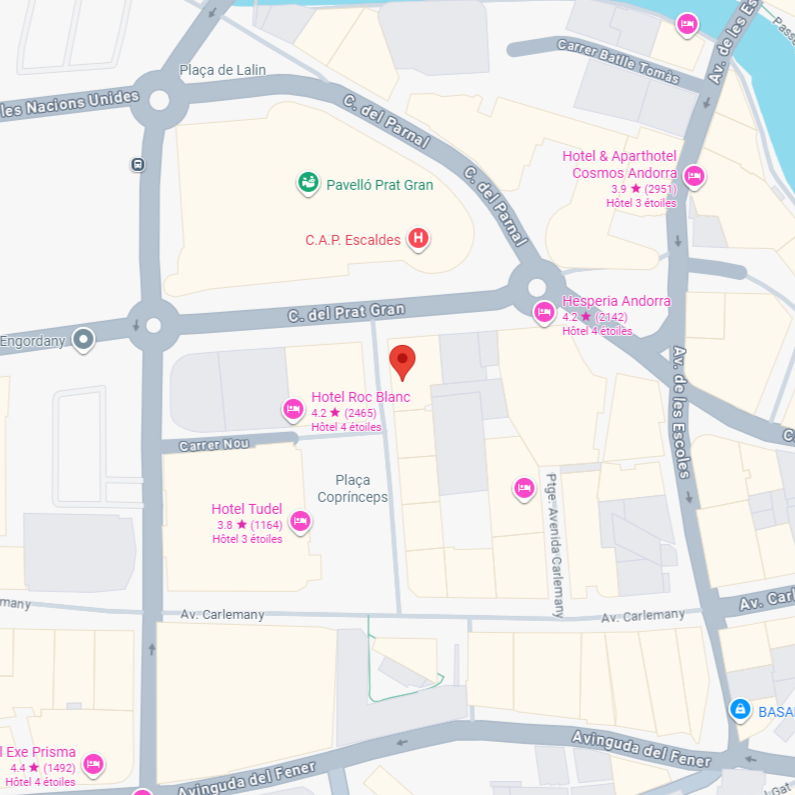

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)