Investing in real estate in Andorra

The Principality of Andorra has implemented reforms designed to enhance its attractiveness to international investors and boost the real estate sector.

The evolution of its tax framework, combined with the signing of a bilateral agreement with France, has helped position the Andorran real estate market as a particularly competitive and strategic destination.

Investing in real estate in Andorra

A dynamic and resilient real estate market

The Andorran real estate market is showing steady growth, supported by strong demand from residents and foreign investors attracted by the economic stability, attractive tax framework and exceptional quality of life in the Principality.

The mountainous topography of the territory naturally limits new construction, creating a structural scarcity of supply which favours the appreciation of properties in the medium and long term.

Numerous real estate opportunities

Andorra offers a diversified market that suits all types of investors:

Modern apartments

In urban or residential areas, new or fully renovated.

Prestigious chalets

And contemporary villas in the valleys

Commercial premises and apartment buildings

For professional investors.

Recent programs are distinguished by high-end features: high-performance thermal insulation, home automation, meticulous finishes and compliance with European energy standards.

This combination of comfort, energy efficiency and scarcity of land enhances the attractiveness of the Andorran market.

Investing in Andorra means combining profitability and security.

Competitive rental yields

Rental demand remains very strong, particularly in central areas such as Escaldes-Engordany, Andorra la Vella or La Massana.

Depending on the type of property and its location, net returns are between 4% and 6%, or even more on certain luxury properties.

Two main segments can be distinguished:

Long-term rental

Driven by permanent residents, cross-border workers or expatriates.

Seasonal rental

Very active thanks to mountain tourism,

skiing and wellness.

Short-term rentals are regulated and require a municipal tourist license.

The tight rental market — due to a rate of construction lower than population growth — contributes to the stability and profitability of real estate investments.

Optimize your investments thanks to a clear and advantageous tax framework

Attractive property taxation

Andorra stands out for having one of the most advantageous tax environments in Europe. Investors benefit in particular from:

No property tax

No wealth tax

No inheritance or gift tax

A moderate and decreasing capital gain on real estate

These tax advantages make Andorra a privileged territory for securing and growing real estate assets, often much more favorable than in neighboring countries.

Gaining access to the residence through a well-considered wealth management strategy

Investing to obtain Andorran residency

Real estate investment can also be used as leverage to obtain Andorran tax residency, particularly through passive residency for investors.

This option requires:

A minimum investment of €600,000

in Andorran assets

(real estate, financial or corporate).

A presence of at least

90 days per year

on the territory.

The deposit of a guarantee with the Andorran Financial Authority (AFA)

€50,000 + €12,000 per dependent.

This scheme allows you to fully benefit from the tax, economic and asset advantages of the Principality, while ensuring a sustainable establishment in a safe and prosperous environment.

In summary

Investing in real estate in Andorra means choosing a stable, growing and fiscally attractive market, where the scarcity of supply reinforces the value of assets.

Whether you’re looking to diversify your assets, generate rental income, or prepare for relocation to the country, Andorra represents a high-potential investment destination in the heart of the Pyrenees.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

Find us:

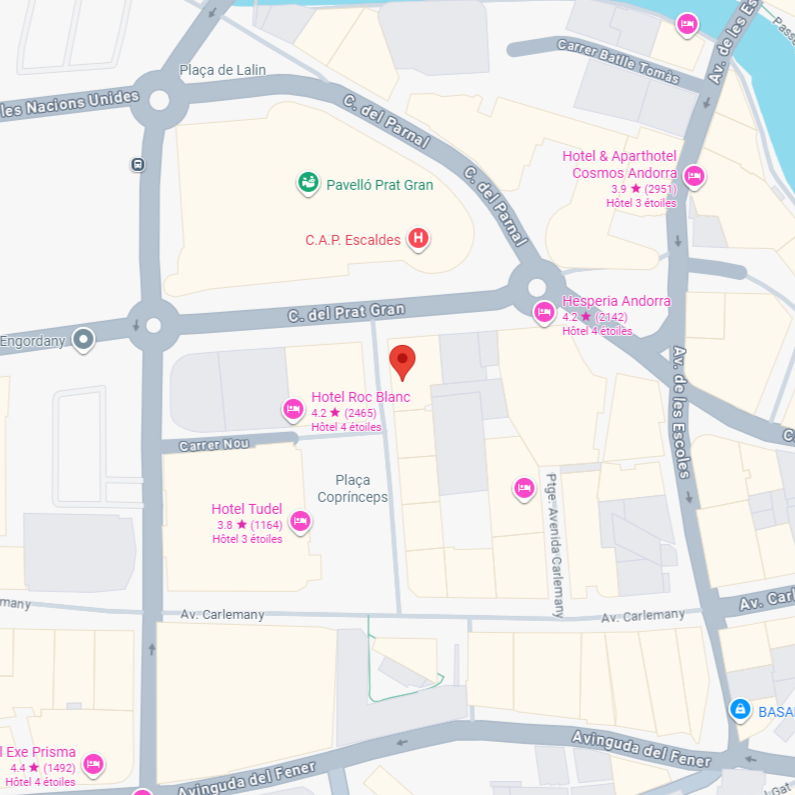

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)