Diversify and secure your assets

Diversify your assets

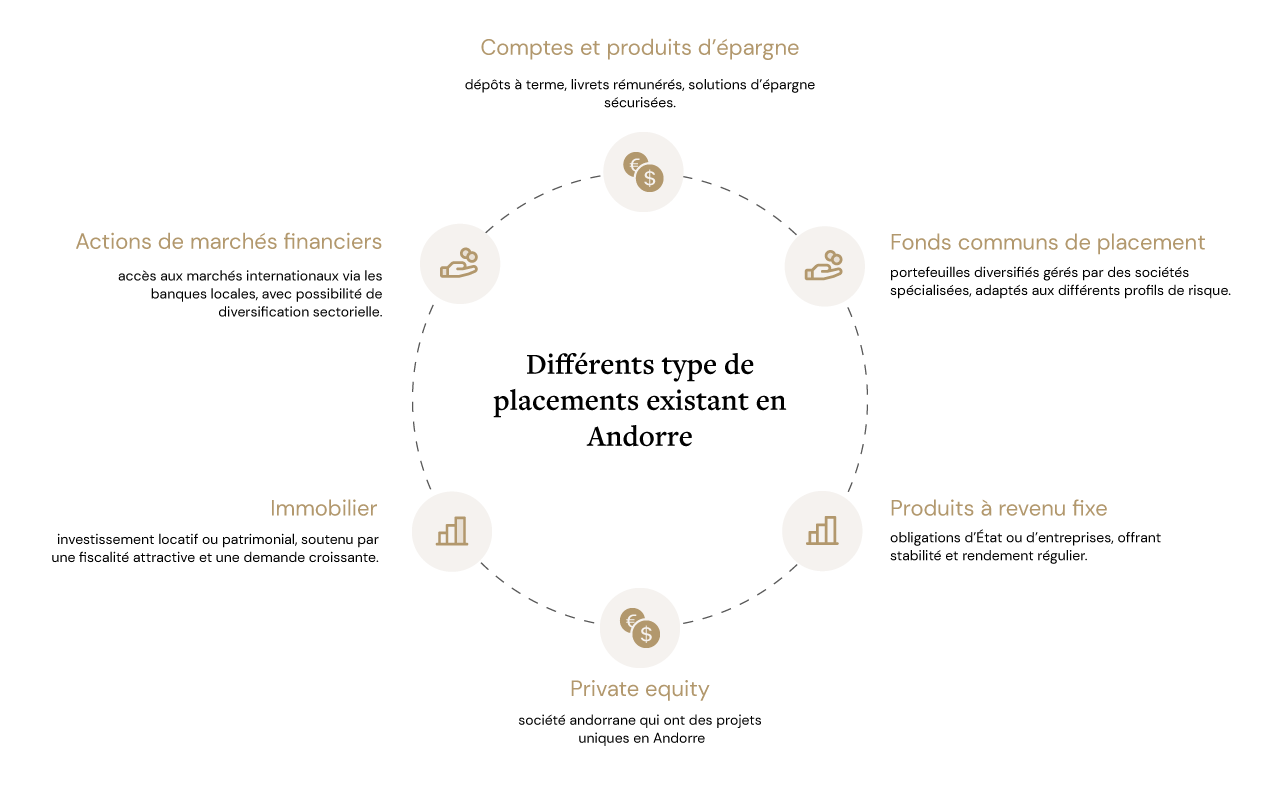

The different types of investments available in Andorra

Structuring, supporting, and growing your ambitions

The advantages of these financial investments:

Moderate taxation (income and corporate taxes among the lowest in Europe) enhances the attractiveness of these investments.

Andorran banks enjoy a reputation for stability and confidentiality, which attracts international investors.

Andorra has signed bilateral agreements, notably with France, to secure financial and asset flows.

ACTUALITÉ FISCALES

Dernières publications

Frequently Asked Questions

Quelle est la fiscalité d’Andorre ? Comment en bénéficier ?

Andorra offers an attractive and transparent tax system: a corporate tax capped at 10% and an income tax also limited to 10%. There is no wealth tax, no property tax, no inheritance tax, and no tax on dividends. Certain advantages are reserved for Andorran residents and others are accessible to people who develop activities from the principality.

Comment déplacer mon activité française en Andorre ?

To start a business in the Principality of Andorra, you must first ensure that your business is not regulated and does not require any special authorization to operate in the country.

Next, you need to choose the scheme that suits your project and complete the necessary formalities in Andorra and France to start your business.

SOL Fiscal assesses the feasibility of your project and ensures that all necessary steps for its completion are anticipated and carried out. The firm provides comprehensive support from start to finish, both in Andorra and in France.

Est-il compliqué de s’installer en Andorre ?

Moving to Andorra is relatively simple with the right support. Administrative procedures are centralized, and the Principality offers a welcoming environment. We handle the entire process: paperwork, housing, healthcare, schooling, opening a bank account, and more.

Comment devenir résident en Andorre ?

To obtain residency in Andorra, there are two main options:

Active residence: linked to the exercise of a professional activity or the creation of a local company.

Passive residence: intended for people wishing to live in Andorra without working there (investors, retirees, etc.).

Each status entails specific conditions (length of stay, investment, or financial obligations). Sol Fiscal advises you on the choice best suited to your situation and handles all the administrative procedures.

Comment créer une société en Andorre ?

Setting up a company in Andorra isn’t very complicated; what’s more complex is figuring out how to operate legally in the country without being a resident. Am I eligible to set up a company in Andorra?

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

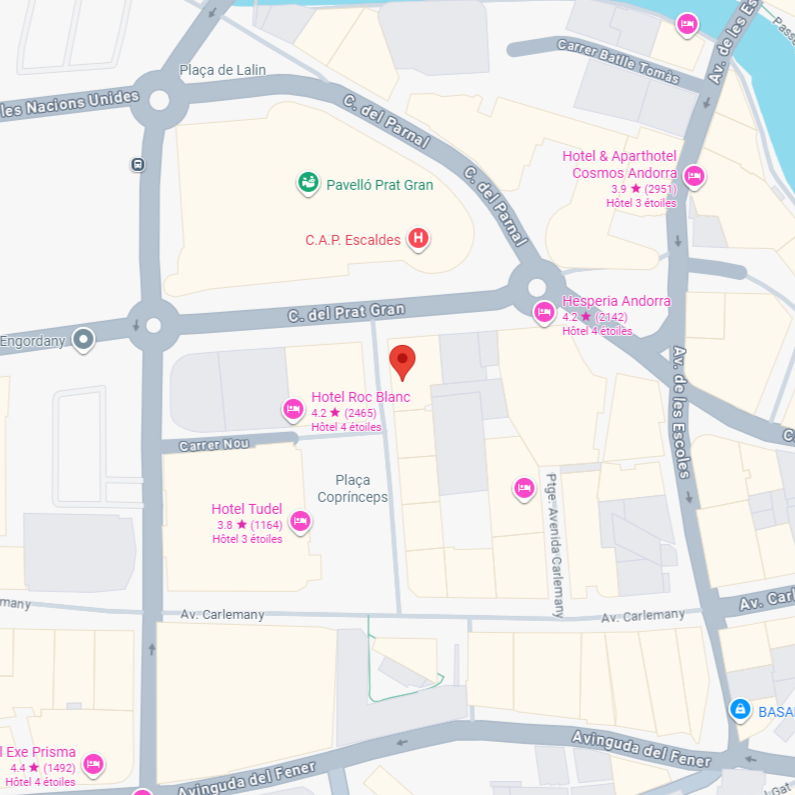

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)