Becoming a resident in Andorra

A strategic choice: reduced taxation, security, and a privileged living environment

What is residency in Andorra?

Why become a resident?

Residency in Andorra is a legal status that allows you to settle permanently in the country.

- Active,

- Passive,

- International projection

Depending on your life plans and professional activities, you have a choice.

Obtaining residency means gaining access to a secure framework, recognized by the Andorran authorities, and benefiting from a stable environment to develop your personal or professional projects.

The residence adapted to your plans

Types of residences

Residency types in Andorra are structured around clear and regulated criteria. Active residency is for those wishing to work or develop a business in the country, while passive residency is geared towards investors or retirees seeking stability and tax advantages. In addition, there are specific schemes designed to address particular situations. This classification helps guide each applicant toward the status best suited to their project, in accordance with the country’s legal and administrative requirements.

Active Residence

Active residency is aimed at people wishing to carry out a commercial activity in Andorra.

Passive residence

La résidence passive cPassive residence is suitable for people without commercial activity in Andorra, such as investors, rentiers, retirees or international entrepreneurs.onvient aux personnes sans activité commerciale en Andorre, comme les investisseurs, rentiers, retraités ou entrepreneurs internationaux.

International projection

Passive residency with international projection is reserved for certain profiles who are required to conduct their business on a global scale.

Obtaining residency

How can I easily obtain my residency?

It is essential to have expert guidance from the very beginning of your residency application in Andorra.

The tax and legal implications require careful analysis and a strategy tailored to your specific situation to ensure a smooth transition and optimize your choices.

Similarly, the practical aspects of your arrival—housing, financial planning, and integration—must be meticulously considered to guarantee a seamless transition.

Tax and Legal Matters

We assist you with tax and legal matters.

Installation and structuring

We support you in the installation and structuring of your assets.

After residency...

Once you are a resident (or even before) you will have many wishes and needs (buying a main residence, looking for investments, etc.)

We help you realize your projects: acquiring a house or apartment, investing in real estate or local financial products, developing local businesses,…

These decisions must be part of a comprehensive vision, combining asset security and growth opportunities. Our firm supports you in implementing these projects, offering tailored solutions and personalized guidance.

It is essential to have expert guidance from the very beginning of your residency application in Andorra.

The tax and legal implications require careful analysis and a strategy tailored to your specific situation to ensure a smooth transition and optimize your choices.

Similarly, the practical aspects of your arrival—housing, financial planning, and integration—must be meticulously considered to guarantee a seamless transition.

Moving to Andorra

Obtaining residency in Andorra

Do you wish to move abroad and obtain Andorran residency?

We guide you through every step, from analyzing your profile to the official issuance of your residence permit.

Evaluate your profile and your goals

Complete diagnosis:

income, assets, family ties, French tax obligations and life plan.

Objective :

define the establishment strategy that reconciles practical implementation and asset optimization.

We define the corporate purpose of your organization:

We identify the residency status best suited to your project:

Professional activity, investment, or salaried relocation.

Then we develop the corresponding administrative, tax, and wealth management strategy to secure your move to Andorra.

Final objective:

A simple, legal and long-lasting installation that protects your assets and makes your new life easier.

What should you do once you are a resident to bring your projects to life?

Transform your status into concrete opportunities:

home, investment, sustainable future.

Becoming a resident of Andorra is just the first step. Very soon, you will want to make your plans a reality:

- Buying a house,

- Investissement immobilier

- Or the development of local activities.

These decisions must be part of a comprehensive vision, combining asset security and growth opportunities.

Our firm supports you in the implementation of these projects, offering tailored solutions and personalized follow-up.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

Find us:

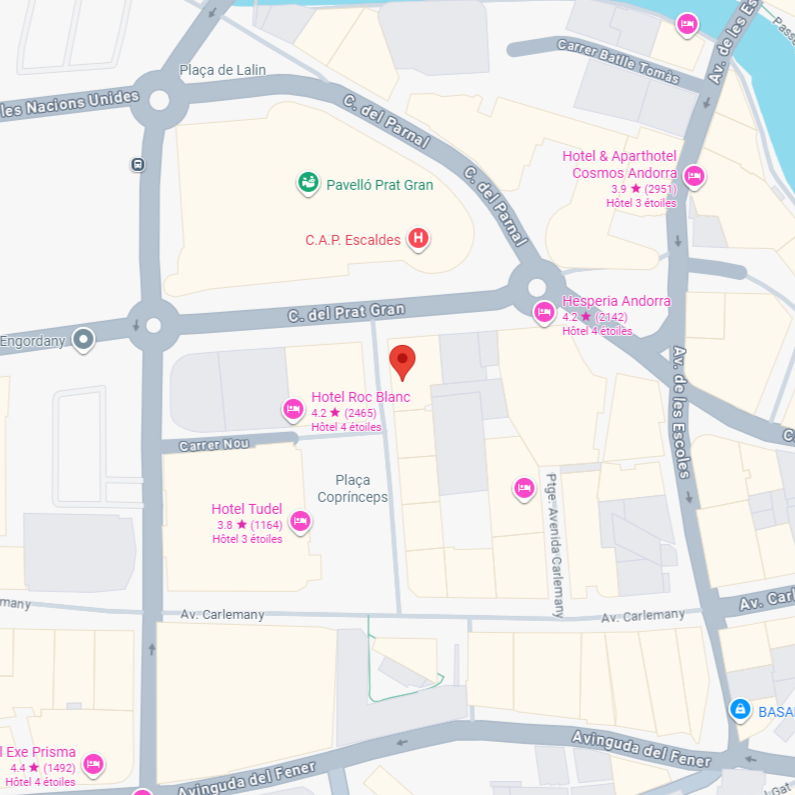

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)