Your Family Office in Andorra

SOL Fiscal advises wealthy families and

businesses on their tax and

estate planning issues in France and Andorra.

Our philosophy

To offer sustainable solutions that fully protect your interests

Expertise and confidentiality

Sol Fiscal combines local and international expertise to offer you personalized support in tax optimization, investments and inheritance.

We bring together the essential skills for the success of your projects in Andorra, in compliance with legal and ethical obligations.

Transparency and independence

Transparency guides each of our decisions, for objective, methodical support that is always aligned with your real interests, without bias or external influence.

Our advice is based on your situation and your objectives. We move forward alongside you with complete confidence and transparency.

Attentive and close to you

Aware that every family has its own history, values and priorities, we attach particular importance to understanding your situation and expectations.

In order to choose suitable solutions, in perfect harmony with your family objectives and with the protection and transmission of your assets.

OUR AREAS OF ACTION

Completely dedicated to our customers

Over the years, we have brought together the essential services for your success.

Sustainable investment strategy

Combine performance, sustainability and legal security in the management and structuring of your assets.

Tax and wealth optimization

Reduce your taxes with tailored and secure cross-border tax strategies.

Transfer, transmission and succession

We support you in your sales or donation projects, guaranteeing a smooth transfer.

Administrative support and private secretarial services

We simplify your administrative procedures in Andorra with efficient and personalized management.

OUR EXPERTISE

Tax and legal advice

The Sol Fiscal firm assists you in all your legal and tax procedures between France and Andorra, whether it concerns relations between companies established on both sides of the 2 territories (parent-subsidiary regimes, tax integration, cross-border distributions), the applicable rules regarding VAT or situations of dual tax residence.

Our expertise is based on a thorough understanding of Franco-Andorran tax treaties, covering income, capital gains, and wealth transfer. We secure your transactions within a compliant, optimized, and sustainable framework.

Corporate taxation

Find the best strategy to achieve your goals: Plan your operations in advance and ensure your activities comply with tax regulations, both in France and internationally.

Personal and estate taxation

Fulfill your tax obligations and secure the transfer of your assets: Be informed about the schemes applicable to your profile so you can plan ahead and benefit from them.

OUR EXPERTISE

Asset diversification

Our firm will support you throughout your projects.

Real estate investment, development & subdivision

Financial investments & securities

Acquisition of a primary or secondary residence

OFFICE

A team at your service

A team ready to advise and support you in the creation and development of your activities in the Principality of Andorra.

Matthieu Bech, a French tax specialist and Andorran resident, assists his clients with their development and diversification strategies, whether for their business activities or their assets. He also advises on company structuring and managing the challenges related to business transfers.

Matthieu Bech – Managing Partner – Tax Law

Léa Lopez

Partner – Project Management

Sergi Brillas

Partner – Institutional Relations

Carlos Sasplugas

Customer relations – Installation

Cédric Pierrot

Gestion de projets

THE PRINCIPALITY OF ANDORRA

Much more than just a tax tool,

A life project

“Andorra is much more than a small country with low taxes; it is a principality that has preserved strong traditions and values. It offers a comfortable and safe living environment, magnificent views of the mountains and vast valleys.

It enjoys a dry climate and sunny skies almost all year round, but also offers high-end services, numerous tourist activities, and gastronomy that lives up to its rich cultural heritage.”

ACTUALITÉ FISCALES

Dernières publications

Frequently Asked Questions

Comment nous rencontrer ?

We are open Monday through Friday, by appointment only.

Comment joindre le cabinet ?

You can contact us at +33 6 19 23 24 75. Léa Lopez, partner at the firm and project manager, will be happy to answer your questions and help you schedule an appointment.

You can also send us an email at contact@sol-fiscal.com. We will contact you by phone within 48 hours.

Comment le cabinet accompagne-t-il ses clients ?

In order to provide you with the best possible support for your various challenges, it is essential that we meet and examine the various tax issues you will encounter.

In any case, we do not provide legal or tax advice over the phone during an initial contact.

Quels sont nos tarifs et prestations ?

The firm charges flat fees based on the assignment to be performed, depending on the type and complexity of the case.

Contact us

Our firm is at your service to quickly assess your situation!

E-mail address :

contact@sol-fiscal.com

Telephone:

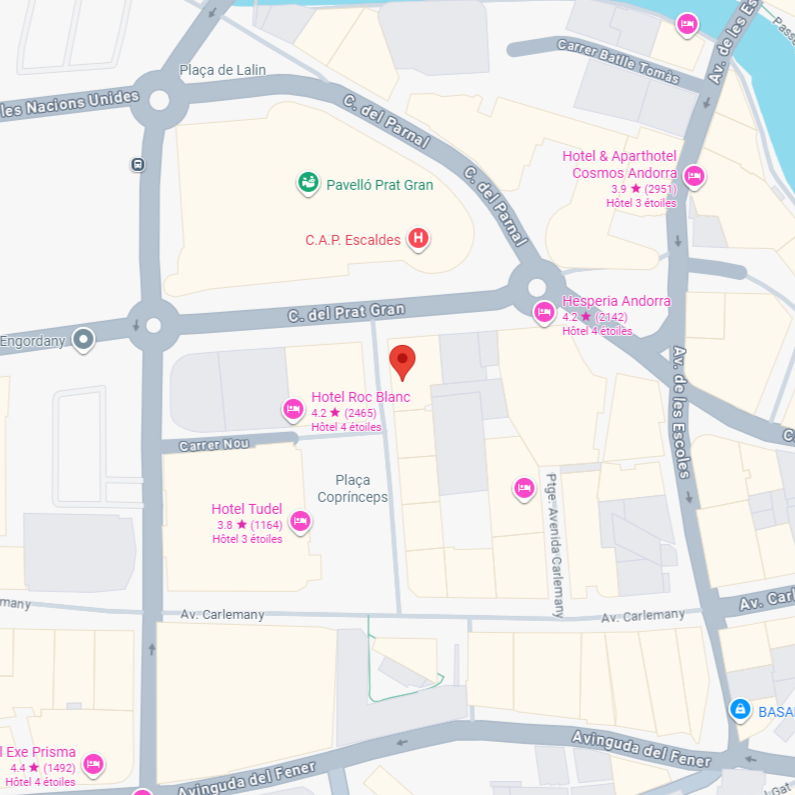

Find us:

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)