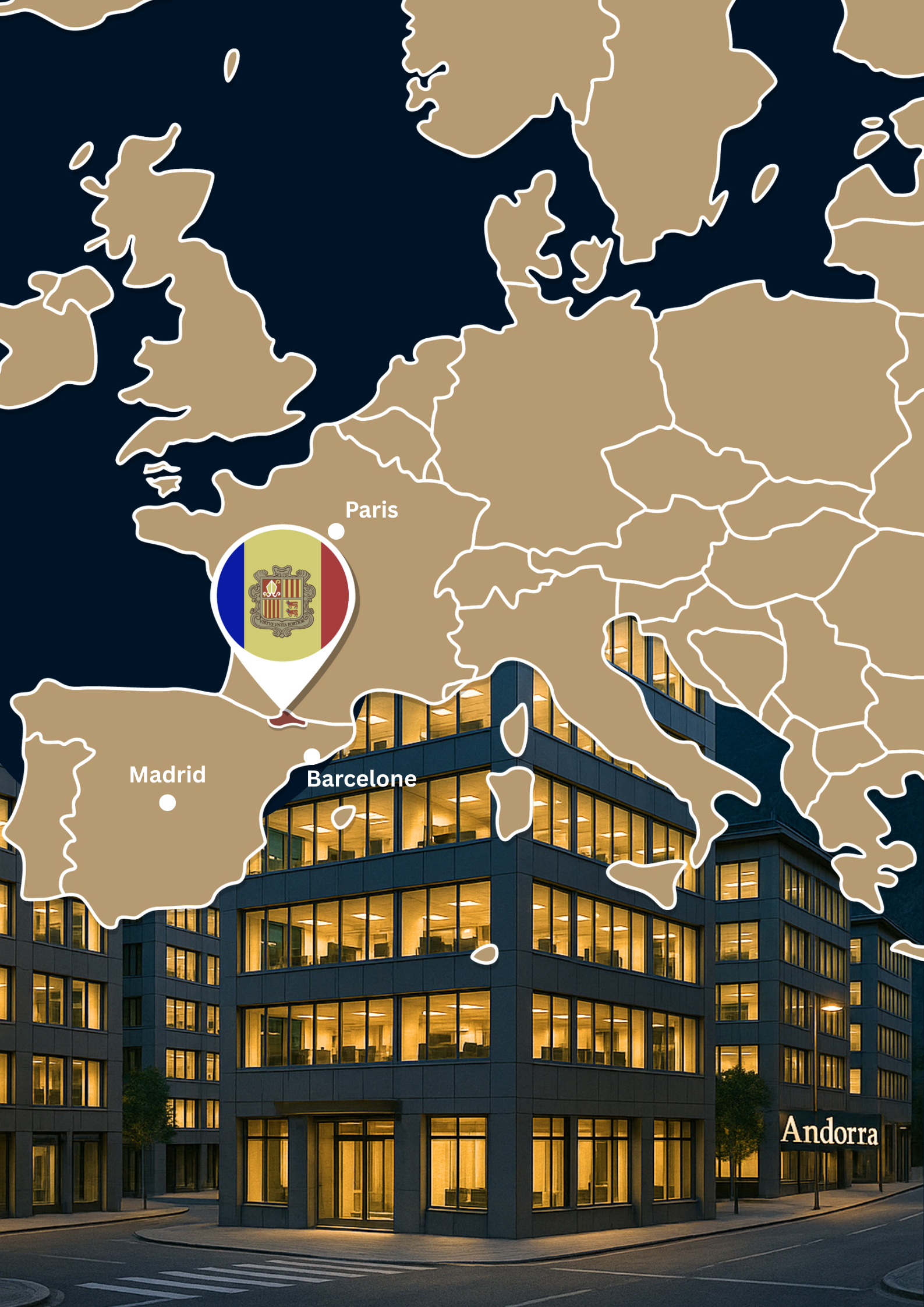

Set Up

Your Company

in Andorra

Are you actively seeking solutions to optimize your taxes and diversify beyond France or the EU?

Discover why thousands of people choose Andorra every year.

Why set up a company in Andorra?

You may not know it yet, but Andorra is probably one of the best destinations to uncover new opportunities, develop your projects, and ensure the sustainability of your activities.

What kinds of projects make Andorra a great option?

- 01

Family or friends' business ventures,

- 02

Wealth diversification,

- 03

Succession and inheritance planning,

- 04

Second home or expatriation,

- 05

Geographic diversification,

- 06

Securing assets outside of your country,

- 06

Developing international business,

- 07

Restoring a group's or company’s competitiveness,

- 08

Corporate reorganization or restructuring,

- 09

And many more...

One or more of these ideas resonate with you ? Or you have other projects in mind you’d like to discuss ?

We’re here to listen, ready to answer your questions and help bring your plans to life, while fully complying with the laws of the countries in which you operate.

The Advantages of Andorra

A Highly Attractive Tax Regime…

%

Corporate tax

%

Corporate tax

%

Dividend tax

%

IGI (VAT equivalent)

%

Employer and employee contributions

%

Employer and employee contributions

%

Income tax

Political and Economic Stability

Stable and predictable government :

Andorra is a parliamentary principality with remarkable political stability. It is co-headed by the President of France and the Bishop of Urgell, while executive power lies with a democratically elected government. This provides a secure climate for investment, with minimal risk of instability or sudden reforms.

Well-managed economy with consistent growth :

Despite its small size, Andorra boasts a healthy, diversified economy (tourism, retail, services, finance, technology) with steady growth. Its public debt—among the lowest in Europe—reflects prudent and responsible governance.

Geographic Proximity to France and Spain

Easy access for European entrepreneurs :

Located between France and Spain, Andorra is reachable by car from Toulouse, Perpignan, or Barcelona. Though it has no airport of its own, it is well connected via nearby airports and train stations. Shuttle services are available from Toulouse and Barcelona.

Strong integration into cross-border trade :

Though not an EU member, Andorra has signed cooperation agreements with the EU—particularly in trade, tax, and financial regulations—facilitating economic exchange with its larger neighbors.

Lower Operating Costs

Professional services generally less expensive than in France :

For example, renting office space in Andorra la Vella or Escaldes is significantly cheaper than in major French cities. This also applies to operational costs (electricity, office supplies) and company management (accounting, etc.).

Lower social contributions :

Employer contributions are around 15.5%, much lower than in France, while still providing decent health and retirement coverage.

A Modern Regulatory Framework

Recent reforms to encourage foreign investment :

Since 2012, foreigners have been allowed to own 100% of a company in Andorra. Previously, a local partner was required.

Increased transparency and compliance with international standards :

Andorra has adopted international transparency practices (automatic exchange of banking information, anti-money laundering regulations, OECD norms), enhancing its companies’ international credibility.

An attractive legal and tax environment for entrepreneurs :

It now has a simplified corporate law, digitalized administrative procedures, and a competitive, clear, and predictable tax regime.

A Promising Market for Many Sectors

E-commerce, digital services, finance, consulting, elite sports :

Andorra’s tech-friendly environment appeals to freelancers, digital agencies, consultants, and service companies thanks to high connectivity, economic stability, and a supportive innovation ecosystem. Professional athletes also choose Andorra for high-altitude training, the country’s safety, and its healthy lifestyle in the mountains.

Niche positioning in luxury, winter sports, and duty-free retail :

With its upscale tourism offer, renowned ski resorts, and international retail outlets, Andorra is an attractive market for brands in luxury, sports, and retail. Tourist inflow and a strong shopping culture further enhance opportunities for specialized players.

Technological Infrastructure

Reliable high-speed internet access :

Andorra is well-equipped: nearly the entire country is covered by fiber optics, including mountainous areas.

Increasing support for tech businesses and startups

Incubation programs, modern coworking spaces, and digitalization initiatives are being developed to attract and support tech companies.

Privacy Protection

Less media and administrative exposure than in France

Companies are rarely featured in the media. While business registers are accessible to authorities, they are not open to the public—minimizing visibility.

Legal framework respectful of business confidentiality

As long as international standards are followed (AML, tax transparency), commercial and personal data remain protected.

Wealth Transmission and Asset Protection

A favorable environment for wealth management

Andorra’s simple inheritance rules and flexible local laws make intergenerational transfers easier for residents, while reducing risks linked to regulatory instability.

Secure asset transfer and succession planning

Andorran law allows you to plan your estate according to your personal wishes, with fewer constraints from other jurisdictions. This ensures continuity for family businesses and long-term capital protection.

Find us

Plaça Coprínceps, Passatge Bonaventura Móra Munt, 4Bis – AD700 Escaldes-Engordany Entresol 2 (ES)

E-mail address

contact@sol-fiscal.com

+ 33 6 19 23 24 75